Japan 2018 Tax Reform Proposal for individuals

We summarize the Japan 2018 Tax Reform Proposal related to resident individual income taxpayers as below. Broadly speaking, this proposal contains tax increases for high-income individuals.

All amendments below are scheduled to be effective for individual income tax on or after 2020.

1. Decrease salary income deduction

Under the 2018 Tax Reform Proposal, salary income deductions applicable to taxpayers having salary income decreases by JPY 100,000. Moreover, the maximum deductible amount reduces to JPY 1,950,000 (currently JPY 2,200,000).

On the other hand, a specific measure is introduced to protect some categories of employees (e.g., having a family with small children or elderly parents) against the tax rise as above.

2. Revision of basic deduction

Under the 2018 Tax Reform Proposal, basic deduction increases to JPY 480,000 (currently JPY 380,000).

The basic deduction is currently applicable to every individual taxpayer. However, under the 2018 Tax Reform Proposal, if a taxpayer whose aggregate taxable income exceeds JPY 24,000,000, allowable amount is gradually reduced. Also, if the aggregate taxable income exceeds JPY 25,000,000, the basic deduction is no longer applicable.

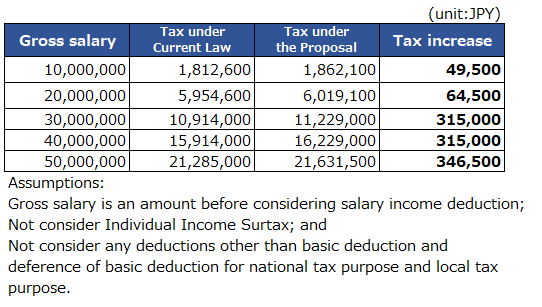

Considering the reforms on salary income deduction and basic deduction above, the tax increase for a resident taxpayer with salary income (total of national and local tax) can be roughly calculated as follows:

3. Revision of blue form tax return deduction

Under the 2018 Tax Reform Proposal, blue form tax return deduction applicable to an individual taxpayer who files an application for blue form tax return for his/her business or rental income and keeps its books is decreased to JPY 550,000 (currently JPY 650,000) unless he/she files its self-assessment tax return via e-Tax.

Since the basic deduction increases (unless aggregate taxable income exceeds JPY 24,000,000), total deduction can increase by JPY 100,000 if such taxpayers file their tax returns via e-Tax.

Please note the 2018 Tax Reform Proposal is expected to be approved by the end of March 2018 and is not effective at the time of this post.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof.