Deduction of director remuneration

For Japanese tax purposes, deduction of director remuneration is restricted. It is only deductible if it follows the rules stipulated under the tax law.

We summarize general rules on deductibility of director remuneration.

Director remuneration (base salary)

In general, deduction of director remuneration is permitted if it is paid on a monthly fixed basis.

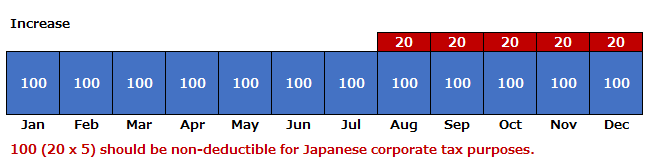

Where the monthly fixed remuneration increased, the increased portion should be non-deductible for Japanese corporate tax purposes.

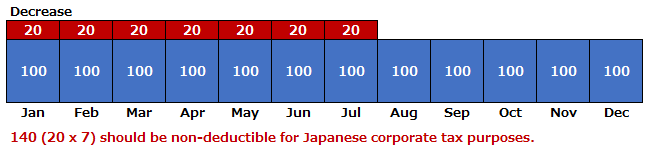

On the other hand, where it decreased, the difference between the previous amount and the reduced amount should be non-deductible.

However, monthly fixed remunerations that increased or decreased can be deductible if certain conditions are met.

Generally, the conditions are that either:

- an annual revision is made within three months from the beginning of the fiscal year;

- there has been a significant change in the position or responsibility of the director; or

- payments are decreased due to a severe financial deterioration of the company.

Monthly fixed on “net” basis

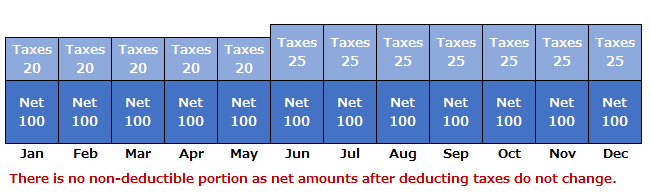

Deduction of director remuneration related to the monthly fixed compensation above should generally be determined on “gross” basis before deducting withholding income taxes and social insurances.

In some cases, there is an arrangement that a company guarantees to pay monthly fixed remuneration to a director on “net” basis.

For instance, a company agrees to pay monthly director remuneration of JPY 1 million on a net basis after deducting withholding income taxes and social insurances. The gross amount should be calculated so that it reaches the expected net amount by applying a “gross-up” calculation.

This kind of arrangement is sometimes made to expats director seconded from group company outside Japan. In this case, the gross amount of director remuneration would increase or decrease when withholding income tax or social insurance rates are changed during a fiscal year. The company had to recognize non-deductible director remuneration due to the changes in the past.

However, there was a tax reform in 2017. The tax reform introduced that monthly director remuneration can be deemed as monthly fixed if “net” amount after deducting withholding income taxes and social insurances remains same every month even if the gross amount of monthly director remuneration varies due to change of withholding income or social insurance rates.

Bonus payments to a director

Bonus payments to a director of a company are also subject to the rule of deduction of director remuneration for Japanese tax purposes.

They are generally not deductible for Japanese corporate tax purposes.

There are some exceptions to the above general rule for director bonus. However, it should be subject to restrictive conditions. For example, a cash bonus to a director can be deductible if a company meets takes the following procedures:

- submits a certain report including an expected bonus amount and date of payment to Japanese tax authority within a month after shareholder meeting of the company; and

- pays the bonus following the report.

Definition of director for tax purposes

In a nutshell, a person registered as a director of a company in its corporate registration should be a director of the company for Japanese corporate tax purposes. Therefore, if a job title of some employee is “Managing Director” or “Vice President,” it does not immediately mean that the person is a director for tax purposes unless the person is also registered as director in the corporate registration.

However, Japan also has ‘deemed director’ rules for tax purposes. Under the rule, employees who engage in the management of the company are deemed as directors even if they are not registered as directors.

Japan branch manager of a foreign company

A branch manager of a Japan branch of a foreign company can be treated as an employee. In general, he or she is not treated as a director for Japanese tax purposes. Japan branch manager is generally registered as “representative in Japan” of a foreign company in its corporate registration. Representative in Japan falls under the different category from a director of a foreign company.

Therefore, remuneration and bonus paid to the representative in Japan are generally deductible provided that the person is not a registered as director in the corporate registration and is not seen as deemed director for Japanese tax purposes.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.