Summary of Japanese subsidiary vs. branch

A foreign corporation can conduct the business through a Japanese subsidiary or a Japanese branch of a foreign corporation. Subsidiary and branch are taxed similarly; however, there are some differences. Below is the summary of the key features and differences between Japanese subsidiary vs. branch.

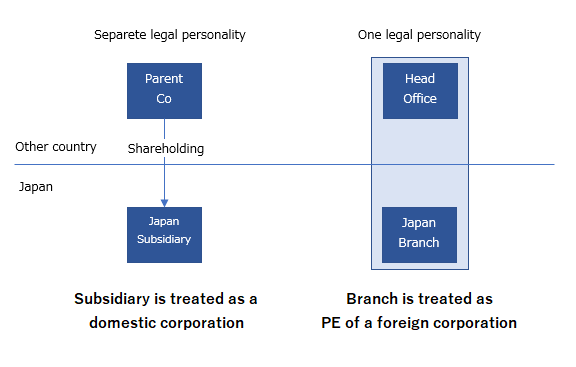

Legal form and classification under Japanese tax law

Subsidiary

In general, a Japanese subsidiary can either be a Kabushiki Kaisha or Godo Kaisha. They have a separate legal personality from a parent corporation. For Japanese tax purposes, they fall into the category of domestic corporations. Any income recognized by the domestic corporation is subject to Japanese corporate tax.

Branch

Japanese branch creates a permanent establishment (PE) of a foreign corporation. Head office and Japanese branch have a same legal personality. In this case, profit and loss attributed to Japan branch are subject to Japanese corporate tax.

Effective tax rate

Japanese corporate taxes are composed of two (2) national taxes and two (2) local taxes.

Effective tax rate below includes following taxes:

- Corporation tax (national)

- Local corporation tax (national)

- Corporate inhabitant income tax (local); and

- The income-based portion of enterprise tax (local).

However, it does not include enterprise taxes based on measures other than income, which is so-called “Size-based Enterprise Taxation.”

Subsidiary

The effective rate varies depending on the amount of paid-in capital of a subsidiary.

Where the paid-in capital of a company is JPY 100 million or less, the effective tax rate in the Tokyo area is approximately 34.6%.

On the other hand, where the paid-in capital of a company is more than JPY 100 million, the effective tax rate in the Tokyo area is approximately 30.6%. However, in this case, the company is subject to the Size-based Enterprise Taxation.

Branch

In general, the same rules as Subsidiary should apply. However, the paid-in capital of Japan branch, to determine whether it exceeds JPY 100 million depends on the amount of its head office.

Size-based Enterprise Taxation

Subsidiary

Where the paid-in capital of a subsidiary is more than JPY 100 million, the company is subject to the Size-based Enterprise Taxation in addition to corporate income taxes. There are “value-added basis enterprise tax” and “capital basis enterprise tax.”

Broadly, value-added basis enterprise tax in Tokyo is calculated as 1.26% of the sum of wages, net interest, net rent and taxable income for the year. Also, capital basis enterprise tax in Tokyo is calculated as 0.525% of the sum of paid-in capital and capital surplus.

Branch

Generally, the same rules as Subsidiary should apply. However, capital basis enterprise tax for Japan branch should be taxed on an adjusted capital amount of a foreign corporation prorated by the number of employees in Japan branch out of the entire number of employees of the foreign corporation.

Special corporate surtax for a specific family corporation

Subsidiary

A special surtax for family corporations may apply to a subsidiary if more than 50% of shares in the parent company are ultimately owned by an individual and their family (including other subsidiaries of the family) and meets other conditions related to the amount of paid-in capital and retained earnings etc.

Branch

The special surtax for family corporations does not apply to Japan branch, regardless of its ownership structure.

Loss carry forward

Subsidiary

A subsidiary can carry forward net operating loss (NOL) for subsequent ten (10) years (nine years if the company recognized the NOL in fiscal years commenced on or before March 31, 2018).

The use of NOL is limited to 50% of current year taxable income (55% or more if the company utilizes the NOL in fiscal years commenced on or before March 31, 2018).

However, this limitation does not apply to small and medium-sized enterprises (SME). A subsidiary can be the SME if its paid-in capital is JPY 100 million or less and paid-in capital of parent companies which wholly own the Subsidiary (directly or indirectly) is JPY 500 million or less.

Note that a corporate taxpayer who applied for blue form tax return status can apply the NOL carry-forward rules.

Branch

Generally, the same rules as Subsidiary should apply. However, the paid-in capital of Japan branch, to determine SME status depends on the amount of its head office.

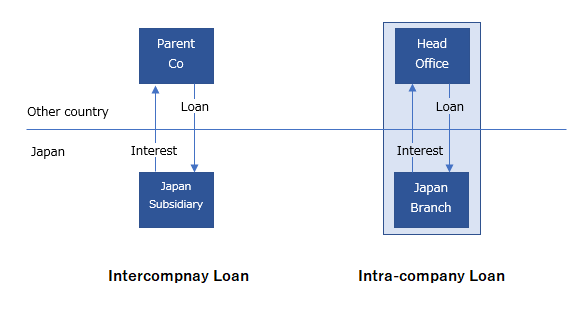

Deductibility of related party interest

Subsidiary

Interest on an intercompany loan paid to an offshore related entity is generally deductible. However, it should be subject to withholding tax at a rate of 20.42% unless reduced or exempt rate under a relevant tax treaty is applicable.

Also, interest deduction of intercompany loan might be restricted by the application of followings rules under the Japanese domestic tax law:

- Transfer pricing;

- Thin capitalization rule; and

- Earning stripping rules.

Branch

Generally, the almost same rule as Subsidiary should apply. However, thin capitalization rule does not apply to Japan branch; instead, Japan branch should be subject to another interest restriction rules.

Intra-company transaction (only related to Japan branch)

In the case of a Japan branch, there might be intra-company transactions (e.g., transaction between Japan branch and its foreign head office).

Under the Japanese domestic tax law, Japan branch can generally recognize the intra-company transaction in the calculation of its taxable income as long as these transactions are reasonable in light of respective functions performed by Japan branch and head office.

However, intra-company loan interest or royalty, etc. should be disregarded if there is a provision under the relevant tax treaty to deny these transactions. Note a Japan branch which is operating banking business etc. can recognize intra-company loan interest even in this case with some restrictions.

Director remuneration

Subsidiary

In most cases, a subsidiary has at least one Japanese resident director (although it may not be required for Japanese legal purposes).

In general, director’s remuneration is deductible only if it is paid on a monthly fixed basis.

Also, bonus payments made to a director of the subsidiary are generally not deductible unless the bonus payment meets certain conditions.

Branch

Japan branch needs to have a Japanese resident branch manager who is registered as a representative in Japan.

Unlike the directors of the subsidiary, the branch manager can be treated as an employee for Japanese tax purposes. Therefore, restriction rules regarding monthly fixed base salary and bonus for directors do not apply to the branch manager.

Please note, however, there is ‘deemed director’ rules under Japanese domestic tax law. Employees who engage in the management of the corporation are treated as directors for tax purposes.

Profit repatriation

Subsidiary

Dividends from an unlisted Japanese subsidiary are subject to withholding tax at a rate of 20.42% under Japanese domestic law. This withholding tax rate can be reduced or exempt by the application of the relevant tax treaty.

Branch

A branch can remit its earnings to the head office free of Japanese withholding tax.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.