Japanese tax depreciation

Under the Japanese tax depreciation rule, fixed assets should be depreciated over useful lives stipulated under the tax law regardless of the useful life for accounting purposes. However, there are some de-minimis rules.

We summarize general rules on depreciation under the Japanese tax law.

General rule

For Japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the Japanese tax law (Tax Useful Life).

If useful life applied for accounting purposes is shorter than the Tax Useful Life, the excess over the accounting depreciation is treated as a non-deductible expense for tax purposes.

In some cases, fixed assets are depreciated based on the contract period of leasehold property, etc. according to GAAP. Accounting useful life is generally much shorter than the Tax Useful Life.

Except for the limited case, tax depreciation based on the contract period should not be acceptable. In this case, excess depreciation may cause a large book-tax difference and increase the taxable income (in the earlier years before reversing).

Note: Under the tax law (not GAAP), there is a cap of annual tax depreciation as explained above. However, on the other hand, there is no floor. Therefore, if a company does not recognize any depreciation for accounting purposes, it should be acceptable from a tax point of view (since the taxable income of the company increases if there is no depreciation).

Tax Useful Life

Here are examples of Tax Useful Life applicable to fixed assets often held by companies operating businesses in Japan.

- Leasehold improvement: 18 years (in practice)

- PC (not for server use): 4 years

- Furniture and fixture (made of metal): 15 years

- Software: 5 years

Depreciation method

Japanese tax depreciation should be calculated based on the following depreciation method depending on the category of assets:

- Leasehold improvement: Straight-line method only

- Fixture and furniture (including PCs): Declining balance method but can select straight-line method if taxpayer file a notification to tax office.

- Software (intangible): Straight-line method only

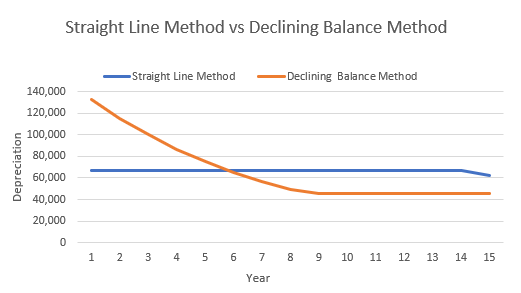

Depreciation under the declining balance method can recognize much more depreciation than that under the straight-line method in initial years. However, the calculation should be more complicated than the straight-line method.

Example of Japanese tax depreciation

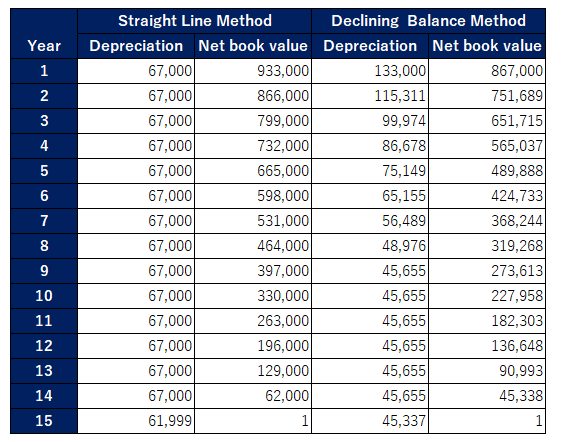

Here is an example of Japanese tax depreciation based on the straight-line method and declining balance method.

(Assumptions)

Purchase price: JPY 1,000,000

Tax Useful Life: 15 years

(Summary)

(Detail)

If a company recognizes depreciation exceeding the above tax depreciation for accounting purposes, the difference should create a book-tax difference and be added back to the taxable income.

Based on the above example, if a company recognize depreciation of JPY 200,000 in year 1 for accounting purposes, and the company applies the straight-line method for tax purposes, JPY 133,000 (JPY 200,000 – JPY 67,000) should be added back to its taxable income.

De-minimis rules

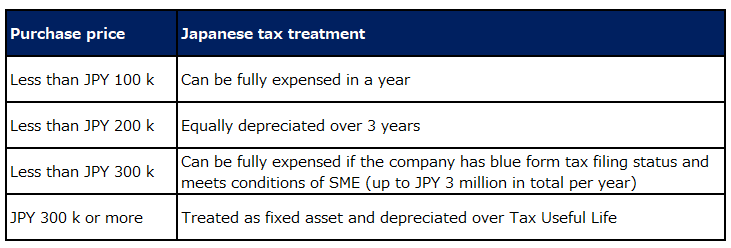

As exceptions to the general depreciation rules, there are de-minimis rules applicable based on a purchase price of a fixed asset.

(1) Low-Value Asset

If the purchase price of the fixed asset is less than JPY 100,000, it should be treated as Low-Value Asset for tax purposes.

Low-Value Asset can be fully expensed when it is acquired.

(2) Minor Depreciable Asset

If the purchase price of the fixed asset is less than JPY 200,000, it can be treated as Minor Depreciable Asset for tax purposes.

Minor Depreciable Asset should be equally depreciated over three years. This depreciation can be applied irrespective of the Tax Useful Life and depreciation method which should have been applied to the fixed asset.

(3) Special rule for SME

If a company meets the following conditions, the company can fully expense the fixed asset when it is acquired if the purchase price is less than JPY 300,000.

- The company has a blue form tax return status; and

- The company is treated as small and medium-sized enterprises (SME) for Japanese tax purposes.

However, the total amount to be expensed by the application of this rule is limited to JPY 3 million in a year.

A company can be SME if its paid-in capital is JPY 100 million or less and meets certain other conditions.

Below is the summary of the above de-minimis rules.

Depreciable asset tax return

Separately from corporate income tax returns, companies are generally required to file a depreciable asset tax return. This is to report depreciable fixed assets held on January 1 of each year by January 31 of that year.

In the depreciable asset tax return, companies do not have to include Low-Value Asset and Minor Depreciable Asset. However, fixed assets which applied the Special rule for SME need to be reported.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.