Japanese tax refund of retirement income

If you have previously worked in both Japan and your home country and then receive a retirement allowance which Japanese withholding tax is withheld from, there may be a Japanese tax refund of retirement income in a specific situation as explained below.

Ordinary Japanese withholding tax system on retirement allowance for Japanese tax resident

Where Japanese tax residents who filed a relevant document received a retirement allowance from their ex-hiring company, the retirement allowance should be subject to favorable withholding tax calculated below.

Calculation formula

(Retirement allowance – Retirement Income Deduction) x 1/2 x Income Tax Rate

Retirement Income Deduction increases depending on the length of his/her service years in a company. The amount of deduction is JPY 400,000 per year for the first 20 service years. JPY 700,000 per year is applicable for the years exceeding 20 years after that.

For instance, if he/she worked for 25 years in a company, Retirement Income Deduction will be JPY 11,500,000 (JPY 400,000 x 20 years + JPY 700,000 x 5 years).

Generally, only half (1/2) of retirement allowance after deducting Retirement Income Deduction is taxable (Half-off Taxation). However, the director of a company whose service year is five (5) years or less, the Half-off Taxation is not applicable.

Income Tax Rate is a progressive tax rate varied from 5% to 45% (plus surtax). In the case of retirement income, applicable tax rate only depends on the amount of taxable retirement income.

In most cases, withholding tax is the final tax for Japanese tax residents. They do not have to file a tax return to report the retirement allowance.

In case of non-resident who has previously worked in Japan.

If non-resident received a retirement allowance which includes a portion for his/her service in Japan, the retirement allowance corresponding to the service period in Japan should be subject to Japanese withholding tax as far as it is paid in Japan.

However, in this case, calculation of withholding tax is entirely different from tax residents as follows:

Calculation formula

Retirement allowance x Service Period in Japan / Entire Service Period x 20.42% (including surtax)

As shown above, no favorable tax treatments such as Retirement Income Deduction and Half-off Taxation is available.

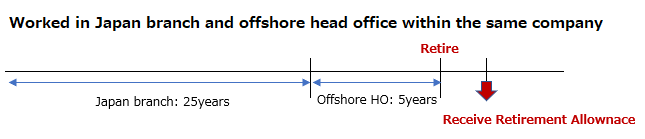

A typical case where 20.42% withholding tax applies

Below is the typical example where 20.42% withholding tax applies.

If a retiree received JPY 30 million, in this case, calculation of Japanese withholding tax is as follows:

JPY 30 million x 25 years/30 years = JPY 25 million (the portion of service period in Japan)

JPY 25 million x 20.42% = JPY 5,105,000

Even if the foreign head office (not the Japan branch) of a company paid the retirement allowance, it should generally be deemed as “paid in Japan” for Japanese tax purposes as far as the company has Japan office.

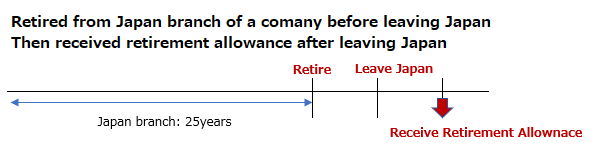

When to determine resident/non-resident

Whether a retiree is tax-resident or not will make the significant difference in withholding tax calculation.

In case of retirement income, a retiree is generally a tax resident if he/she has been in Japan at the time of resignation of the company.

Therefore, unlike typical case above, retirement allowance paid to the retiree is subject to withholding tax applicable to Japanese tax resident if he/she has submitted a relevant document to the company under the following case.

Optional tax filing for non-resident for tax refund

If retiree received a retirement allowance as non-resident for Japanese tax purposes, 20.42% withholding tax should be unavoidable.

However, under the Japanese tax law, such non-resident retiree can opt to be subject to taxation on retirement income applicable to tax residents by filing a tax return to Japanese tax authority (Optional Tax Filing).

Accordingly, non-resident can also claim favorable taxation on the retirement income as well as the resident if he/she files the tax return after leaving Japan.

If the retiree in the typical case above opts the Optional Tax Filing, income tax on retirement income under the Optional Tax Filing should be approximately JPY 1,1 million. Therefore, the retiree can claim the tax refund of approximately JPY 4 million.

Procedures to apply the Optional Tax Filing

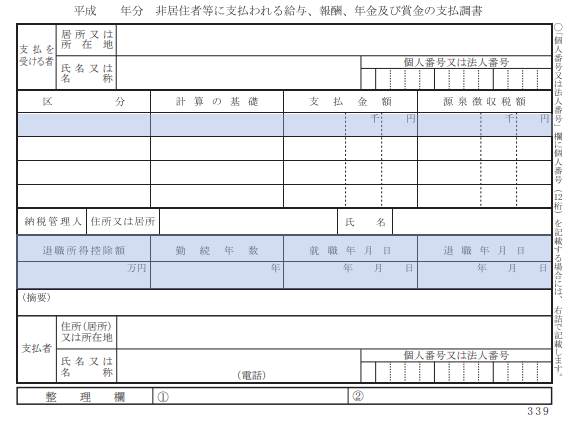

If you consider applying the Optional tax filing, you need payment slip as shown below.

The company you had worked issued the slip. In case of retirement allowance, you can find descriptions or numbers highlighted in blue area below.

If you decided to claim the tax refund, you also need to appoint Tax Agent (so-called “nozei-kanri-nin”) in Japan. Japanese tax authority can only remit the refundable tax to bank accounts opened in Japan. The account holder should be the taxpayer or Tax Agent.

If you appoint a licensed Japanese tax professional as a Tax Agent, Tax Agent can prepare the tax return and correspond with tax authorities for the refund on behalf of you.

Points to consider

As summarized above, Optional Tax Filing may give you a tax refund.

However, there are some points to consider.

There is a statue of limitations of five (5) years to claim a refund.

Also, if your service period in Japan is short while the service period outside Japan is long, there may be some cases that there is no tax refund.

Finally, if you have credited the 20.42% withholding tax against your income tax in your home country, the tax refund may have an adverse effect for your income tax in the home country (e.g., tax credit decreases). Please consult with tax professional in your home country for this matter.

Free trial calculation

Non-resident taxpayers have a right to apply the Optional Tax Filing. However, the filing should be in Japanese. It should be burdensome for non-Japanese taxpayers.

We will support you to claim a refund. Also, we offer a free trial calculation to check whether you are in a refund position.

If you are considering claiming Optional Tax Filing, please feel free to contact us.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.