Japanese tax treatment for offshore share compensation plan

If you are a Japanese tax resident working in Japan subsidiary or branch and receive shares in parent company outside Japan based on share compensation plan, you need to file individual income tax return to Japanese tax authorities. In most cases, you need to pay additional income tax for the income equivalent to the share compensation. This may also apply to non-resident previously working in Japan during a specific period.

Outline of general share compensation plan

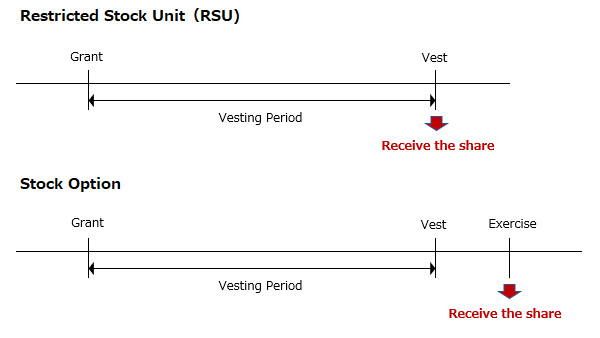

In general, share compensation plan such as Restricted Stock Unit (RSU), or Stock Option includes a condition which requires employees to work in the company for specific future periods. Accordingly, as a general structure, an employee receives share compensation as follows:

In the case of RSU, employees receive shares at the time of vest.

On the other hand, employees receive a right to receive shares at the time of vest. Therefore, they receive shares when they exercise the right although vest and exercise may co-occur.

Japanese income tax treatment

In general, for Japanese individual income tax purposes, employees need to recognize taxable salary income when they received shares. No taxation occurs at the time of grant.

Accordingly, employees should recognize salary income at the time of vest in case of RSU or at the time of exercise in case of Stock Option.

Salary income under the share compensation plan delivering shares in parent company is not generally subject to withholding tax unlike the monthly base salary or cash bonus paid by Japan subsidiary or branch. Employees receiving such shares in foreign parent company need to file a tax return to Japanese tax authorities. Moreover, as they are not subject to withholding tax, the additional tax payment should be required in most cases.

A simple way to file a tax return

When you submit the tax return to report salary income for the share compensation, you need to check when you received the share for tax purposes, and share price and the exchange rate at that time. Although it depends on the share plan and supporting function in the company you belong, it may take much time.

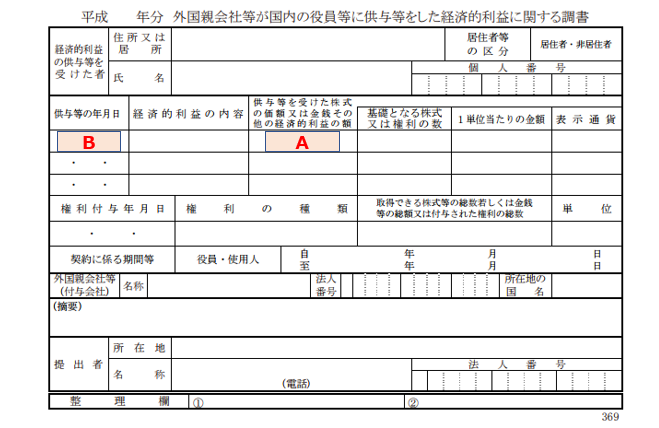

However, if you can get a slip so-called “Reports on employees’ stock options, granted by offshore parent companies” (Offshore Stock Option Report) from Japan entity you belong, you can quickly calculate your salary income by using the report as follows:

Amount described in “A” x Exchange rate on the date described in “B.”

Exchange rate should be T.T.M (Telegraphic Transfer Middle Rate)

Offshore Stock Option Report

Where employees of a Japanese subsidiary or branch exercise stock options or restricted stock units, directly granted by an offshore parent company, the Japan subsidiary or branch is required to file a report summarizing the status of their actions during a year by March 31 of the following year.

Based on the report, Japanese tax authorities can investigate whether relevant taxpayers appropriately report their income.

Under the tax law, Japan subsidiary or branch does not have to provide this report to employees. However, some companies provide this report to their employees on a voluntary basis for employees to file their income tax return correctly.

If you work outside Japan during the vesting period

If you work outside Japan during a part of the vesting period, calculation of salary income is bit complex. You may need to allocate salary income between Japan source and foreign source income based on days.

This also applies to non-resident who had worked in Japan during the vesting period.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.