Japan 2018 Tax Reform – Agent PE

The 2018 Tax Reform broadens a definition of Agent PE under the domestic tax law in Japan.

This amendment above is effective for fiscal years of corporation beginning on or after January 1, 2019.

Broaden the definition of Agent PE

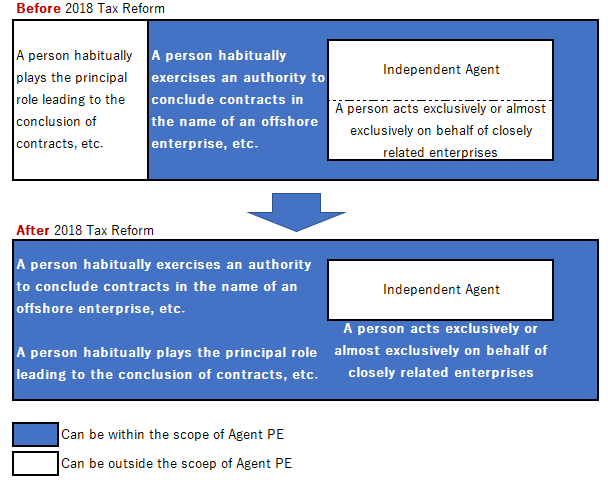

Under the current domestic tax law, if a person in Japan has, and habitually exercises, an authority to conclude contracts in the name of an offshore enterprise, the person in Japan is generally treated as permanent establishment of the offshore enterprise(Agent PE).

Under the 2018 Tax Reform, a person in Japan acting on behalf of an offshore enterprise is treated as Agent PE of the enterprise if the person in Japan:

- habitually concludes contracts, or habitually plays the principal role leading to the conclusion of contracts that are routinely concluded without material modification by the enterprise; and

- these contracts are for the transfer of the ownership of property owned by that foreign enterprise, etc.

Narrow the scope of Independent Agent Status

Moreover, the scope of “independent agent status” is modified.

Under the domestic Japanese tax law, a person acting on behalf of an offshore enterprise is not treated as Agent PE if it carries on business as an independent agent and acts for the enterprise in the ordinary course of that business.

However, under the 2018 Tax Reform, a person acts exclusively or almost exclusively on behalf of one or more enterprises to which it is closely related, that person shall not be considered to be an independent agent.

A person or enterprise is treated as “closely related” if one possesses directly or indirectly more than 50% of the beneficial interest in the other etc.

The scope of Agent PE is briefly illustrated as below.

Application of Tax Treaty

If the definition of PE under a tax treaty is different from the above, definition under the treaty is prioritized.

However, since Japan signed a Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (as known as MLI) on June 2017, which contains Agent PE definition in line with the above tax reform proposal, any developments on each tax treaty status should be continuously monitored.

(Reference)

Ministry of Finance, Japan: Press Release about MLI

http://www.mof.go.jp/english/tax_policy/tax_conventions/press_release/20170608mli.htm

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.