Japan 2018 Tax Reform Proposal on Real Estate Holding Corporation

In general, a foreign corporation without a permanent establishment (PE) in Japan is not subject to capital gains tax on the disposal of shares in a Japanese company.

However, there are some exceptions to the general rule.

The Japan 2018 Tax Reform Proposal amends one of the exceptions as summarized below.

One of the exceptions to the general rule on capital gain tax is that a foreign corporation without PE in Japan is subject to Japanese income tax for capital gain on disposal of shares at approximately a 25% rate by filing a corporation tax return if:

- a company sold falls under the category of a “Real Estate Holding Corporation”; and

- the foreign corporation (together with special related persons) owned more than 2% (5% if listed) of the shares in the Real Estate Holding Corporation at the end of the fiscal year immediately before the year of sale.

A “Real Estate Holding Corporation” is a corporation in which 50% or more of its assets are real estate in Japan, including equities in other Real Estate Holding Corporations (50% Test).

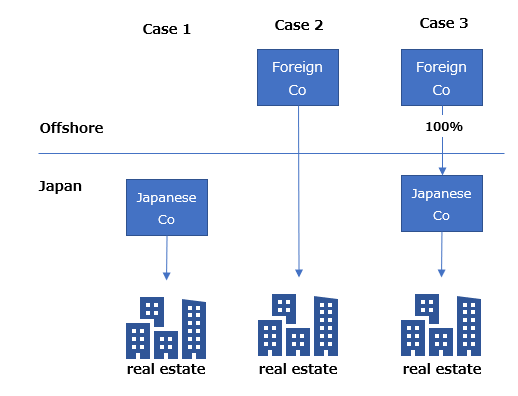

Real Estate Holding Corporations are not limited to Japanese corporations. A foreign corporation can also be treated as a Real Estate Holding Corporation if it meets the 50% Test.

Therefore, all corporations as illustrated below are treated as Real Estate Holding Corporation under the Japanese domestic tax law.

Currently, the 50% Test above is determined at the time of disposal.

However, under the 2018 Tax Reform Proposal, the determination period expands.

A company is treated as a Real Estate Holding Corporation if it meets the 50% Test at any time in the 365 days before the date of disposal.

Please note the 2018 Tax Reform Proposal is expected to be approved by the end of March 2018 and is not effective at the time of this post.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof.