Japanese taxation to non-permanent resident individuals

If you are treated as “non-permanent resident,” your taxable income subject to Japanese income tax might be limited.

This article summarizes Japanese individual income tax treatment applicable to non-permanent resident individuals.

Definition of non-permanent resident

Under the Japanese individual income tax law, there are three types of individuals as below.

(1) Permanent resident

An individual who has a domicile or has had a residence continuously for one year or more in Japan.

(2) Non-permanent resident

An individual who does not have Japanese nationality and has not had a domicile or a residence in Japan for more than five years in total within the past ten years.

(3) Non-resident

An individual who is not a resident (permanent resident and non-permanent resident).

As above, non-permanent resident is an individual who does not have Japanese nationality and does not have a domicile, etc. in Japan for more than 5 years within the past 10 years.

Determination of whether an individual has a domicile in Japan should be analyzed carefully in some cases.

However, an individual who lives in Japan without Japanese nationality is presumed to have a domicile in Japan if he/she has an occupation ordinarily needed to stay in Japan for one year or more continuously.

The scope of taxable income for non-permanent resident

The scope of taxable income on which non-permanent resident is subject to Japanese income tax is as follows:

- Income other than foreign source income; and

- Foreign source income paid in Japan or remitted to Japan from outside Japan

Here are the brief explanations on 1. and 2. above.

Income other than foreign source income

If non-permanent resident recognizes foreign source income, such foreign source income is excluded from Japanese taxable income unless it is paid in Japan or remitted to Japan from outside Japan.

Here are typical examples of foreign source income.

- Certain capital gain arising from the transfer of assets located outside Japan

- Rental income from real estate located outside Japan etc.

- Interest on foreign bond or bank deposit located outside Japan

- Dividend received from foreign corporations

- Salary etc. for the provision of personal services carried out outside Japan

Please note that the exact scope of foreign source income is defined under the Japanese tax law in more detail.

It can be generally said that non-permanent resident is subject to tax on Japan source income such as rental income arising from real estate located in Japan or salary for the provision of personal service in Japan, etc.

However, a non-permanent resident may also be subject to income tax on income other than Japan source income if the income does not fall under any category of foreign source income since the tax law stipulates the taxable income as “income other than foreign source income.”

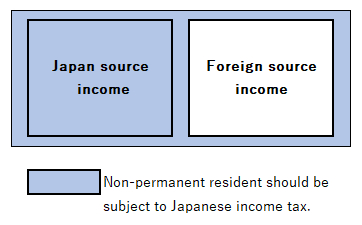

The scope of taxable income for non-permanent resident can be illustrated as below, and a non-permanent resident might be subject to Japanese income tax on an income which is neither treated as Japan source income nor foreign source income.

For example, not all capital gain arising from a transfer of shares located outside Japan is treated as foreign source income (there are some conditions).

Foreign source income paid in Japan or remitted to Japan from outside Japan.

If foreign source income is paid in Japan or remitted to Japan from outside Japan, it is also subject to Japanese income tax.

(1) Foreign source income paid in Japan

As a typical example, if non-permanent resident directly received a dividend of a foreign corporation or a rental income on real estate located outside Japan in a bank account held in Japan, they should be treated as “paid in Japan.”

(2) Foreign source income remitted to Japan from outside Japan

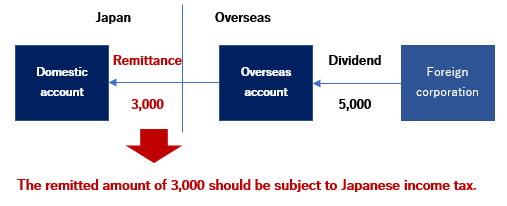

Where foreign source income is paid outside of Japan, a non-permanent resident should be still subject to Japanese income tax on foreign source income up to the amount which is remitted to Japan from outside Japan.

For instance, where a non-permanent resident received a dividend of a foreign corporation of 5,000 in his/her account located outside Japan in a certain year and then remitted 3,000 to his/her bank account held in Japan in the same year, the remitted amount of 3,000 should be subject to Japanese income tax.

Please note if non-permanent resident used a credit card in Japan and the payment was withdrawn from a bank account located outside Japan, the withdrawn amount should also be treated as “remitted to Japan” for Japanese tax purposes.

Please be careful not to trigger Japanese income taxation on your foreign income if you are treated as a non-permanent resident for Japanese tax purposes.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.