Qualified Invoice System for Japanese consumption tax

Qualified Invoice System for Japanese consumption tax will start on October 1, 2023. This article will provide an overview of the Qualified Invoice System and the procedures that need to be taken.

Please note that this article is intended for business entities that do not fall under the category of tax-exempt status.

Please read the following article to check whether you are tax-exempt status for the Japanese consumption tax.

Related Post:

Filing obligation of consumption tax return

What is Qualified Invoice System?

In general, a business entity needs to pay a “net” consumption tax to the Japanese government by filing an annual consumption tax return. The net consumption tax is calculated as the difference between the consumption tax received from customers on revenues (Output Consumption Tax) and the consumption tax paid to vendors on expenses (Input Consumption Tax).

In general, a business entity that is a buyer of goods or services is allowed to credit the Input Consumption Tax shown in the invoice issued by a seller against the Output Consumption Tax of the buyer.

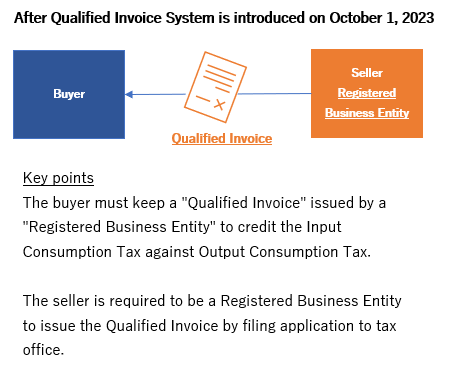

However, after the Qualified Invoice System is introduced on October 1, 2023, the business entity must keep a “Qualified Invoice” issued by a “Registered Business Entity” to credit the Input Consumption Tax against Output Consumption Tax. If the invoice issued by a seller is not a Qualified Invoice, the buyer, in principle, cannot credit the Input Consumption Tax shown in the invoice, although some transitional measure is applicable for years.

Therefore, the Qualified Invoice System may disadvantage your customers (buyers of your products or services) if you do not follow the system.

Note that even if the credit of Input Consumption tax is not allowed on the buyer’s side, as long as the seller is obligated to pay consumption tax by filing a consumption tax return, the seller must pay consumption tax.

How to issue the Qualified Invoice

After introducing the Qualified Invoice System, the business entity that is the seller of goods, etc., is required to be a Registered Business Entity to issue the Qualified Invoice.

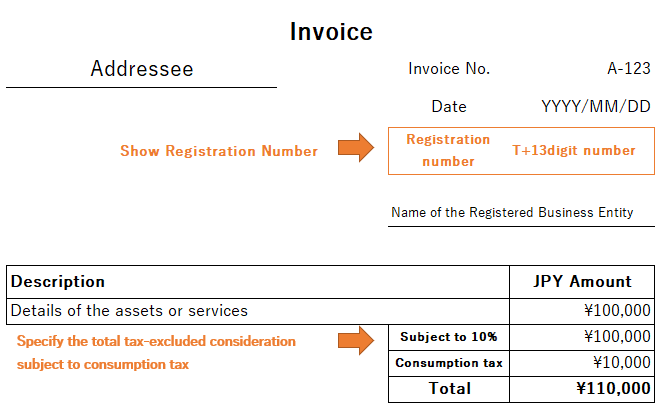

Entities wishing to be registered as Registered Business Entity need to submit an application to the relevant tax office. Once applied, the tax office issues a Registration Number, which is a “T+13digit number”.

The Registered Business Entity must be a taxable business entity that files a consumption tax return. Therefore, if a tax-exempt entity wishes to register, it must elect to be treated as a taxable business itself.

Additional requirement for a foreign business entity without an office in Japan

If a foreign corporation without office premises in Japan needs to register the Qualified Invoice System, the following additional requirements must be satisfied.

- Appoint Tax Agent

Tax Agent must be a Certified Public Tax Accountant or Tax Accountant’s Corporation who can prepare and submit the tax returns on behalf of the taxpayer. - Appoint Tax Payment Administrator

Tax Payment Administrator pays taxes and receives notifications or documents from the Japanese government on behalf of a taxpayer. Any individuals or companies can be generally Tax Payment Administrator if they are in Japan.

Also, these requirements should be kept to maintain the Registered Business Entity status.

Information to be shown in the Qualified Invoice

Registered Business Entity needs to include the following information in the Qualified Invoice.

- Name of the Registered Business Entity (i.e., seller)

- Registration number

- Date of transaction

- Details of the assets or services

- The total consideration that will be subject to consumption tax, depending on tax rates and the applicable tax rate

- Consumption tax to be charged

- Addressee of the invoice (i.e., name of the buyer)

If illustrated, it can be as follows:

In the case of a business entity engaged in a certain type of business that sells goods to an unspecified number of people, such as retailers and restaurants, it is permitted to issue a simplified form of invoice called a Qualified Simple Invoice.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.