Corporate taxation to permanent establishment (PE) in Japan

Japanese taxation to a foreign corporation differs depending on whether the foreign corporation has a permanent establishment (PE) in Japan.

This article summarizes taxation to a foreign corporation having PE in Japan.

Please note explanation below does not generally consider an application of tax treaty.

Permanent Establishment (PE) in Japan

Under the Japanese domestic tax law, following place or person should be treated as PE.

- a branch, an office, a factory or any other fixed place of business of a foreign corporation (Direct PE)

- a place in Japan where a foreign corporation conducts construction or installation work etc. (Construction PE)

- a person having an authority to conclude contracts on behalf of a foreign corporation or any of persons performing similar functions (Agent PE)

Determination of whether a foreign corporation has a PE in Japan should be scrutinized on a case by case basis.

However, in general, Japan branch with a registered office and a representative in Japan (branch manager) should be treated as Direct PE.

Also, a foreign corporation should be deemed to have Agent PE if there is a person having an authority to conclude contracts on behalf of the foreign corporation. The 2018 Tax Reform broadens the definition of Agent PE under Japanese domestic tax law (please see below for detail)

Related Post:

Japan 2018 Tax Reform – Agent PE

The scope of taxable income

A foreign corporation having PE in Japan should be subject to Japanese corporate tax if it recognizes following Japan source income:

- Any income attributable to PE (PE Attributable Income)

- Income arising from the management or possession of assets located in Japan

- Capital gains on disposal of certain assets located in Japan

- Consideration for a provision of certain personal services in Japan

- Rental income from Japanese real estate, consideration of lending a vessel/aircraft to Japanese residents, etc.

- Certain other income which is seen to be derived in Japan

PE Attributable Income above is equivalent to business income and would be the most important category of Japan source income for a foreign corporation having PE in Japan.

On the other hand, please note that a foreign corporation needs to file Japanese corporate tax returns if it recognized Japan source income listed from 2. to 6. regardless of having PE in Japan.

Also, a foreign corporation should be subject to Japanese withholding tax if it recognizes certain Japan source income. Please see below article for detail.

Related Post:

Japanese withholding tax imposed on non-resident

PE Attributable Income

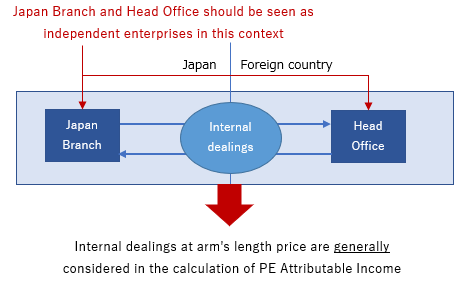

The PE Attributable Income is the income that the PE would have earned at arm’s length if the PE were an independent enterprise carrying on businesses, taking into account functions performed, assets used and after-mentioned internal dealings between the PE and the head office, etc.

Broadly speaking, the concept of PE Attributable Income above is in line with Authorized OECD Approach (AOA) under the current OECD Model Tax Convention.

Therefore, business income realized by a foreign corporation should be subject to the Japanese corporation tax only if it is attributable to the PE in Japan.

On the other hand, if the PE in Japan recognizes foreign source income, it should also be treated as PE Attributable Income for Japanese tax purposes as long as the foreign source income is attributable to the PE. If double taxation arises on the foreign source income, the PE may claim a foreign tax credit for Japanese tax purposes.

Internal dealings

PE Attributable Income should also be determined by taking into account internal dealings within the same legal entity.

Internal dealings to be recognized by the PE should be on an arm’s length basis as if it were a separate and independent enterprise from its head office.

For example, internal dealings between head office and Japan branch can be considered in the calculation of PE Attributable Income.

However, internal guarantee fee or certain other types of internal dealings should be disallowed under the Japanese corporation tax law.

Also, internal dealings should not generally be considered if a tax treaty between Japan and jurisdiction where the foreign corporation is treated as a tax resident does not allow to recognize internal dealings.

Documentation requirement

PE of a foreign corporation is subject to documentation requirement for Japanese tax purposes.

Under the requirement, for example, the PE needs to prepare documents to summarize or explain followings items:

- Transaction summary of external transactions and internal dealings conducted by the branch

- Evidence of external transaction and internal dealings

- Details of assets and liabilities related to external transactions and internal dealings

- Functions performed by the PE and other parts of the foreign corporation and the risks assumed about such functions

Please note the documentation requirement above is construed as a part of the obligation that blue form tax return corporations should comply.

Related Posts:

Blue form tax return system in Japan

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.