Blue form tax return system in Japan

Under the Japanese corporate tax law, many tax benefits are only granted to a corporation with “blue form tax return” status, so-called “Aoiro-Shinkoku(青色申告).”

Here is a summary of the blue form tax return system in Japan.

Example of tax benefit for blue form tax return corporations

Although there are many benefits which are granted to a corporation with the blue form tax return status, major examples are as follows:

1. Carry forward of tax loss

A company can carry forward net operating loss (NOL) for subsequent ten (10) years (nine years if the company recognized the NOL in fiscal years commenced on or before March 31, 2018).

The use of NOL is limited to 50% of current year taxable income (55% or more if the company utilizes the NOL in fiscal years commenced on or before March 31, 2018).

However, this 50% limitation does not apply to small and medium-sized enterprises (SME). SME can fully offset the NOL against the current year taxable income.

A company can be the SME if its paid-in capital is JPY 100 million or less and paid-in capital of parent companies which wholly own the Subsidiary (directly or indirectly) is JPY 500 million or less.

Also, the SME may be able to claim a “carry-back” of tax loss in regular business years.

2. Tax credit by increasing gross salary payment

If a company increases gross salary payment to its employees (excluding director) compared with past years, a company may be entitled to claim a tax credit for a specific portion of the increased gross salary.

3. Lump-sum depreciation of small assets

This is only applicable to the SME.

As an additional de-minimis rule for Japanese tax depreciation, SME can fully expense the fixed asset when it is acquired if the purchase price is less than JPY 300,000.

However, the total amount to be expensed by the application of this rule is limited to JPY 3 million in a year.

4. Special tax depreciation for certain assets

Where a company acquired certain fixed assets which are specified under the tax law, the company can depreciate the fixed assets exceeding an ordinary limit of depreciation under the Japanese tax depreciation rule.

Please see the following article related to Japanese tax depreciation.

Related Post:

Japanese tax depreciation

How and when to apply for the blue form tax return status

If a company would like to apply the blue form tax return status to enjoy the tax benefits, it must submit an “application for filing blue form tax returns”(see the following link).

National Tax Agency website: Application for filing blue form tax returns (in Japanese)

https://www.nta.go.jp/taxes/tetsuzuki/shinsei/annai/hojin/annai/1554_14.htm

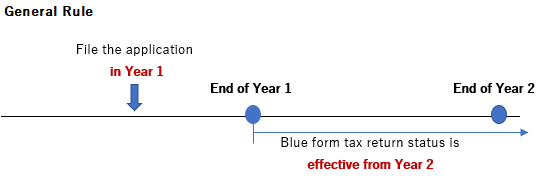

1. General rule

In general, application for filing blue form tax returns shall take effect from the following fiscal year when the application is filed.

For instance, as illustrated below, if a company filed the application in Year 1, the company should be a blue form tax return corporation from Year 2. In this case, the company cannot claim the tax benefits in Year 1.

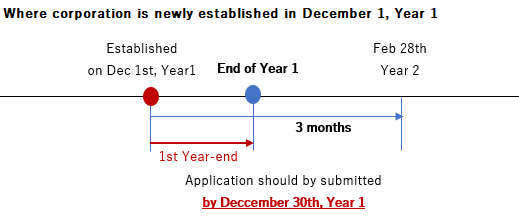

2. Where a company is newly established

Despite the general rule above, there is a special rule applicable to a newly established corporation.

The newly established corporation can be a blue form tax return corporation from its first fiscal year provided that it filed the application before the following dates, whichever it comes earlier:

- within three (3) months after the establishment of the corporation; or

- the first fiscal year-end of the corporation.

Therefore, as an extreme case, if a corporation is established in December 1st in Year 1, and it sets the fiscal year end as every December, the corporation must file the application by December 30th (not December 31st), Year 1 to be the blue form tax return corporation from the initial year.

Mandatory bookkeeping requirement

In exchange for the tax benefits, to maintain the blue form tax return status, corporations must keep books and documents such as follows:

- Balance sheet

- Income statement

- General ledger

- Journal book

- Invoice, voucher, and agreements related to the above.

If a corporation can keep its books using accounting software with documentary evidence, these conditions can be satisfied

Revocation of the blue form tax return status

According to the practical guideline publicized by the National Tax Agency, the blue form tax return status can be revoked.

Following instances can be the trigger:

- The corporation did not keep books appropriately;

- The corporation could not show books or documents to tax authorities upon their request;

- The corporation kept books but concealed or disguised a whole or part of transactions, and the Japanese tax authority doubt the accuracy of the entire books; or

- The company failed to meet the filing due date of corporate final tax returns for the second consecutive year.

The last point might be difficult if the company does not appoint a Japanese tax professional since the corporate tax returns should be prepared in Japanese and there might be some book-tax adjustments.

Conclusion

Three points to get the blue form tax return status from the establishment of a corporation and keep the status are summarized below:

- File the application for filing blue form tax returns on time;

- Keep books with documentary evidence; and

- File corporate tax returns within prescribed filing due date (generally within two months after the fiscal year end).

We believe most corporate taxpayers can satisfy these requirements.

However, if you have some difficulties, please feel free to contact us.

————

This post is a summary based on the applicable tax laws and regulations of Japan effective as at the date hereof. Before making any decision or taking any action, you should consult with other professionals or us.